About Us

At FINCLU, we’re more than financial experts; we’re your guides on the journey to mastering money. Our guiding principle is the dynamic concept known as “FinCLU.” This innovative mindset revolutionizes financial resource management, simplifying the process through three core principles.

Financial Capital: Think of this as the heart of your finances. It includes your money and assets, whether you’re an individual or a business. It’s what fuels your savings, investments, and everyday expenses.

Liquidity: Picture a safety net that’s both strong and flexible. Liquidity ensures you can quickly turn assets into cash without losing their value. It’s crucial for handling unexpected expenses while maintaining overall financial stability.

Utility: Utility is about balancing current needs with future goals. It’s like walking a tightrope, making sure you have enough cash for essentials while investing surplus funds to generate returns. We’re here to help you find that balance and make your money work for you.”

About Founder

Hi there, I am Munish Chauhan, a Financial Freedom Specialist

I am here to help families to achieve financial well being with a structured, client-first approach. As of today, I manage the portfolios of 120+ happy families and have guided over 1,000 people on personal finance through educational sessions

What Started It All

With over 22 years of experience in personal finance—working with multinational banks and startups—I have interacted with people across various backgrounds. One common challenge stood out: most individuals struggle with managing their finances due to a lack of time, financial knowledge, and awareness of key factors like inflation and taxes.

In many cases, the financial solutions offered were not goal-oriented but rather sales-driven and generic. This led to stress, missed opportunities, and financial uncertainty.

I started dreaming of a way to help people take control of their finances, make informed decisions, and build a secure financial future. But I wanted to do it ethically, putting the client first.

After leaving the corporate world, the first step I took was to enroll in The College for Financial Planning and earn the globally recognized Certified Financial Planner™ (CFP®) credential from FPSB, USA. Today, I am proud to be part of a global community of 200,000+ CFP® professionals, with over 2,000 in India.

In 2021, we founded FinClu with a clear mission:

To educate and empower 1,000 families to achieve financial well being by providing personalized strategies with an ethical, client-first approach.

How does it work?

Our Vision

Helping families achieve financial well-being with an ethical & unbiased approach for today's needs and tomorrow's goals

Our Mission

To educate and empower 1,000 families with an ethical, client-first approach, ensuring financial well-being and a secure future

Values

FinClu's core value is to prioritize clients' unique financial needs, fostering long-term relationships based on trust and personalized guidance.

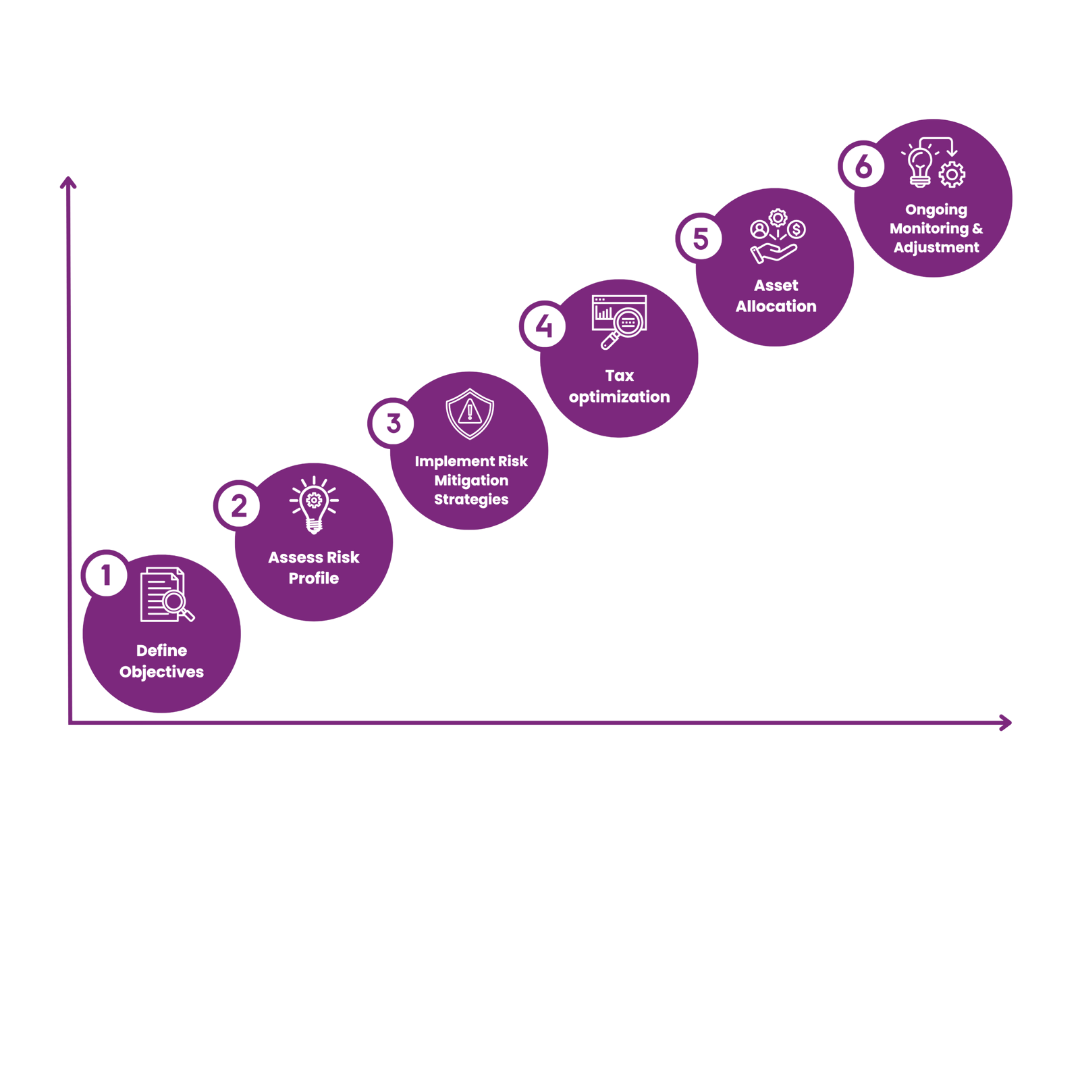

The Process We Follow

- Define Objectives – We start by understanding your financial goals, lifestyle aspirations, and long-term vision to create a roadmap that aligns with your needs.

- Assess Risk Profile – Everyone has a unique risk tolerance. We analyze your comfort level with risk to ensure your investments align with your financial goals.

- Implement Risk Mitigation Strategies – We safeguard your financial future by addressing potential risks through proper insurance, emergency funds, and diversification.

- Tax Optimization – We help you legally minimize tax liabilities so you can retain more wealth and maximize your savings.

- Asset Allocation – A well-balanced portfolio is key to long-term financial success. We allocate assets strategically across different investment avenues to optimize growth and stability.

- Ongoing Monitoring & Adjustment – Financial planning is not a one-time task. We continuously track, review, and adjust your financial strategy based on changes in the market and your life circumstances.

What We Don’t Do

- We don’t push products; our advice is unbiased and client-focused.

- We don’t mix insurance with investments; both serve distinct purposes.

- We don’t believe in one-size-fits-all solutions; every client gets a personalized plan.

- We don’t make decisions based on market noise; we rely on research-driven strategies.

- We don’t leave clients on their own; we provide continuous monitoring and support.

- We don’t participate in contests, rewards, or offers by companies to promote their products.